US Paycheck Paystub Generator 1.6.1

Free Version

Publisher Description

123PayStubs is an online paystub generator for employers, sole proprietors, and self-employed individuals in the United States. With 123PayStubs, employers can create pay stubs for both employees and contractors in minutes.

We are also an e-file service provider (currently supporting Form W-2, 1099-NEC, 1099-MISC, 940, 941 and 941-X). Generating paystubs and filing your payroll tax forms will now become streamlined and efficient.

123PayStubs Features:

• Get your First Paystub for free

• Professional paystub templates that match your style and brand

• 100% Accurate tax calculations

• Download or Email Pay Stubs

• Make corrections for free

• Stay comprised of all tax laws so you don't have to.

Create pay stubs in minutes:

Here’s how our paystub generator works: You enter in some basic information, and 123PayStubs will do the rest. It's that simple. Take advantage of our free paystub templates and customize them by adding your logo. And your first pay stub is free.

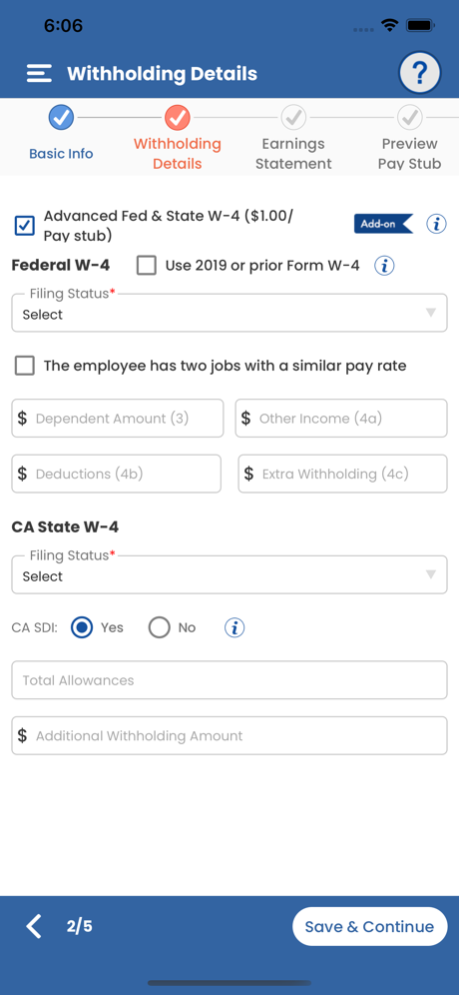

We have tailored our pay stub maker to efficiently meet your needs. You can record your employees' details, add details such as pay periods, pay dates, hours worked, pay rate, and tax information.

Choose a paystub Template: Choose from our list of free pay stub templates and create the pay stub that best suits your business.

Preview Pay Stub: The preview option gives you the ability to verify your information before submitting it. We offer unlimited revisions at no additional cost.

Download/Email Pay Stubs: Upon finalizing your pay stub, you can choose to download it or send it via email. You will also have the ability to view previously created pay stubs.

Opt for Add-ons: Currently, we offer add-ons to record workers' deductions and additional earnings like bonuses and overtime hours, add last YTD values to help us project the current YTD in pay stubs, compute federal and state withholdings using Form W-4s.

123PayStubs is a professional pay stub generator with tax-filing capabilities designed to be utilized by employers, sole proprietors, and self-employed individuals.

File Tax Forms (Currently Supporting Form W-2, 1099-NEC, 1099-MISC, 940, 941 and 941-X):

Form 1099-NEC: Report payments ($600 or more) made to an independent contractor or nonemployees by filing Form 1099-NEC. When you file Form 1099-NEC, form 1096 will be auto-generated.You will receive an email notification when the IRS processes your returns.

Form 1099-MISC: Report miscellaneous payments made to an independent contractor or nonemployees by filing Form 1099-MISC. When you file Form 1099-MISC with 123 Paystubs, Form 1096 will be auto-generated, and we will send it to the IRS.

Form W-2: Report the wages paid to employees and taxes withheld from them during a calendar year by filing Form W-2. When you file Form W-2 with 123 Paystubs, Form W-3 will be auto-generated for record-keeping purposes. You will receive an email notification when the SSA processes your returns.

Form 941: File Employer’s QUARTERLY Federal Tax Return. After entering the information, you can make corrections before transmitting them to the IRS. You will receive notifications when your return has been processed.

Features available in tax returns:

In-built Audit Check: Our audit check analyzes your return based on current IRS rules and standards. It also ensures there are no errors and reduces the chance of rejection.

Preview: Utilize the preview option to ensure all your entered data is correct. You will still be able to make corrections if any before filing it with the IRS/SSA.

Opt for add-ons: Choose to mail recipient copies while filling, and we will send tax returns to designated recipients on your behalf.

Download/Email Copies: Once you e-file your return, you can choose to download it or send it to the recipients directly via email. You will also have the ability to view previously created tax returns.

Apr 12, 2024

Version 1.6.1

- Tax Year 2023 changes for Form 941-X

About US Paycheck Paystub Generator

US Paycheck Paystub Generator is a free app for iOS published in the Office Suites & Tools list of apps, part of Business.

The company that develops US Paycheck Paystub Generator is Span Enterprises LLC. The latest version released by its developer is 1.6.1.

To install US Paycheck Paystub Generator on your iOS device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2024-04-12 and was downloaded 10 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the US Paycheck Paystub Generator as malware if the download link is broken.

How to install US Paycheck Paystub Generator on your iOS device:

- Click on the Continue To App button on our website. This will redirect you to the App Store.

- Once the US Paycheck Paystub Generator is shown in the iTunes listing of your iOS device, you can start its download and installation. Tap on the GET button to the right of the app to start downloading it.

- If you are not logged-in the iOS appstore app, you'll be prompted for your your Apple ID and/or password.

- After US Paycheck Paystub Generator is downloaded, you'll see an INSTALL button to the right. Tap on it to start the actual installation of the iOS app.

- Once installation is finished you can tap on the OPEN button to start it. Its icon will also be added to your device home screen.